ETH Price Prediction: Can Institutional Momentum Push Ethereum to $4,000?

#ETH

- Technical Breakout: ETH price sustains above critical moving averages with narrowing MACD bearish momentum

- Institutional Adoption: $1B+ corporate treasury allocations and ETF developments create structural demand

- Regulatory Tailwinds: Progress in US crypto legislation and staking approvals reduces systemic risks

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge as ETH Trades Above Key Levels

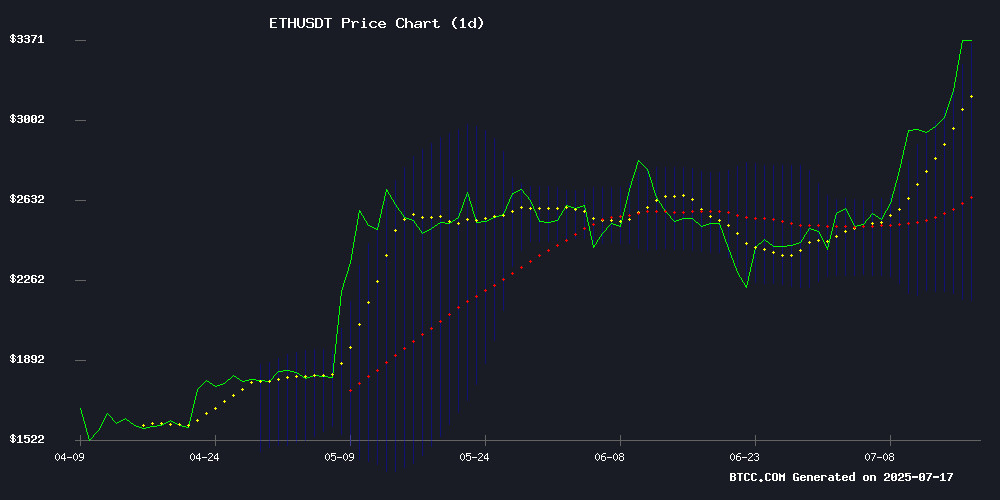

ETH is currently trading at $3,384.63, significantly above its 20-day moving average of $2,762.06, indicating strong bullish momentum. The MACD remains negative but shows signs of convergence as the histogram narrows to -110.4051. Bollinger Bands suggest volatility with the price NEAR the upper band at $3,360.59, while the middle band at $2,762.06 acts as support.

"The technical setup favors buyers," says BTCC analyst Emma. "A sustained hold above the 20-day MA could propel ETH toward $4,000, though traders should watch for potential resistance at the upper Bollinger Band."

Ethereum Market Sentiment Turns Euphoric Amid Institutional Adoption Wave

Positive news FLOW dominates Ethereum's narrative, with ETF inflows, institutional allocations (including BitMine's $1B position), and regulatory progress fueling optimism. Headlines project price targets up to $6,000 as Nasdaq explores staking features for BlackRock's ETF.

"This is a perfect storm of institutional validation," notes BTCC's Emma. "The $90M treasury allocation by GameSquare and Polygon's LAYER 2 developments create structural demand that could sustain this rally."

Factors Influencing ETH's Price

Ethereum Price Surges to $3,432 Amid ETF Inflows and Institutional Adoption

Ethereum's price rallied 20% this week to $3,432, fueled by record ETF inflows and accelerating institutional interest. Spot Ethereum ETFs attracted $1.3 billion over two weeks as public companies like SharpLink Gaming added ETH to corporate treasuries.

The integration of zkEVM technology has enhanced Ethereum's scalability, driving further adoption across both institutional and retail sectors. Market sentiment remains decidedly bullish, with analysts forecasting a near-term test of $3,500 and long-term targets as high as $9,345.

Despite ongoing regulatory scrutiny and security challenges, Ethereum's fundamentals appear stronger than ever. The combination of technological upgrades and growing mainstream acceptance positions ETH for continued outperformance in the digital asset space.

Ethereum Rally: Will ETH Break $3,980 and Hit New Highs in 2025?

Ethereum surged 8.96% in the past 24 hours, trading at $3,441.38 with a weekly gain of 23.58%. Analysts are closely watching the $3,980 resistance level as a critical threshold for the next bull run. Diverging forecasts for 2025 suggest potential highs above $7,500 or lows near $2,338.

The 24-hour trading volume spiked 37.53% to $53.83 billion, reflecting renewed market enthusiasm. Since March 2025, ETH has maintained a steady uptrend, breaking through $2,500 and consolidating between $3,200 and $3,500 in June. Chart patterns indicate a persistent upward movement, with minor consolidations along the way.

Crypto analysts highlight $3,980 as the decisive level for a potential breakout. Candlestick analysis suggests Ethereum is poised for a significant move if it breaches this ceiling. The bullish momentum continues to strengthen, with market participants anticipating a major shift in the near term.

Nasdaq Seeks to Add Staking to BlackRock's Ethereum ETF Amid SEC Review

Nasdaq has filed with the SEC to include staking capabilities in BlackRock's proposed iShares Ethereum Trust (ETHA) ETF. The amendment would allow BlackRock to stake ETH directly or through approved providers, with rewards treated as income. Staked assets must comply with SEC guidelines, and BlackRock must obtain tax clarity before proceeding. The firm will not cover losses from slashing or forking, ensuring shareholder protections remain intact.

The move places BlackRock among a growing list of issuers seeking regulatory approval for staking in U.S. spot Ethereum products. Cboe has similar requests pending for Fidelity's FETH, Franklin Templeton's EZET, and others. NYSE Arca faces parallel filings from Bitwise and Grayscale for their respective ETH funds.

Market observers view these developments as institutional validation of Ethereum's proof-of-stake model. The SEC's decision could set precedent for how traditional finance interacts with crypto-native yield mechanisms.

Ethereum Price Prediction: Can $1B in ETF Inflows Push ETH to $6K?

Ethereum's price surge past $3,300 has reignited bullish speculation, with traders eyeing $6,000 as the next target. The altcoin has gained 9% in 24 hours, supported by shrinking exchange reserves and institutional accumulation.

Exchange reserves have dropped to levels last seen in September 2024, when ETH rallied 90% in 101 days. This supply crunch suggests large investors are moving ETH into cold storage, reducing sell pressure and creating scarcity. CryptoQuant data shows a clear correlation between exchange outflows and price appreciation.

The $1 billion ETF inflow narrative combines with technical strength to fuel optimism. Market structure resembles previous breakout patterns, though volatility remains a constant companion in crypto markets.

GameSquare Allocates $90M to Ethereum Treasury in Strategic Crypto Move

Nasdaq-listed GameSquare Holdings has secured over $90 million in fresh capital, with a significant portion earmarked for Ethereum accumulation and staking. The gaming media conglomerate, which owns FaZe Clan and operates a major North American gaming network, is positioning ETH as a core treasury asset rather than a speculative holding.

Partnering with Dialectic, GameSquare plans to generate yield through staking and on-chain strategies that historically delivered 8-14% returns. This institutional approach reflects growing corporate confidence in crypto's role in treasury management, blending asset appreciation potential with recurring revenue streams.

The move comes amid increasing public company adoption of crypto reserves, with GameSquare potentially becoming one of the largest corporate ETH holders. Its $70 million public equity offering includes a 15% over-allotment provision that could push total proceeds above $80 million, supplemented by a recent $9.2 million raise.

Peter Thiel-Backed BitMine Expands Ethereum Holdings to $1B

BitMine Immersion, a New York Stock Exchange-listed company, has aggressively increased its Ethereum treasury, now holding over $1 billion worth of ETH. The firm purchased an additional $500 million in ETH this week, bringing its total holdings to 300,657 tokens. CEO Jonathan Bates framed the move as a long-term bet on Ethereum's value proposition.

The acquisition spree follows BitMine's strategic pivot from Bitcoin mining to Ethereum accumulation less than a month ago. Market observers note the company aims to eventually stake 5% of all circulating ETH—an ambitious target given the cryptocurrency's $410 billion market capitalization.

Ethereum's price surge to $3,416, a seven-month high, automatically boosted the value of BitMine's holdings. The rally coincides with growing institutional interest, as evidenced by SharpLink Gaming's $225 million ETH purchase earlier this month.

BitMine’s $1 Billion Ethereum Holdings Surpass Ethereum Foundation’s Treasury

BitMine Immersion now holds 300,657 ETH worth $1 billion, eclipsing the Ethereum Foundation’s $665 million treasury. The Nevada-based company’s aggressive accumulation raises questions about influence over Ethereum’s future direction.

The milestone follows BitMine’s recent $250 million private placement, with chairman Tom Lee outlining ambitions to stake 5% of all ETH—a move that could grant outsized governance power. Corporate ETH accumulation may reshape network security and decision-making.

Lightchain AI Set to Launch in July Amid Polygon's Layer 2 Dominance

Polygon solidifies its leadership in Ethereum Layer 2 scaling with the April 2025 rollout of Polygon 2.0, featuring zkEVM rollups that push throughput beyond 7,000 transactions per second. The network's new AggLayer protocol further streamlines cross-chain operations through zero-knowledge proof aggregation.

Against this backdrop, Lightchain AI prepares for a July debut, positioning itself as a complementary force in decentralized technology. The project emphasizes transparency and community governance, aiming to unlock novel use cases for developers building atop Polygon's infrastructure.

Market observers anticipate Lightchain's launch could catalyze the next evolution of blockchain applications, particularly in AI-integrated solutions. The timing coincides with growing institutional interest in scalable Layer 2 ecosystems.

Ethereum’s Surge Amid US Crypto Legislation Advances

Ethereum (ETH) has surged 35% this week, breaching key resistance levels at $2,100 and $2,500 to trade above $3,400. The rally coincides with the U.S. House advancing three crypto bills—the CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance State Act—following President Trump’s negotiations with Republican critics. Regulatory tailwinds are fueling optimism across digital asset markets.

Technicals suggest ETH’s next major test lies at $3,950, a level intersecting with a descending trendline. A confirmed breakout could pave the way toward all-time highs. The second-largest cryptocurrency has rebounded sharply since its March low of $1,380, outperforming broader market sentiment.

Ethereum Analysis: Structural Momentum Aligns With $4,000 Price Projection

Ethereum's price surge past $3,400 reflects robust institutional demand and growing market confidence. SharpLink Gaming and BitMine have significantly expanded their ETH holdings, with the latter now holding over $500 million in assets. This institutional accumulation tightens supply, reinforcing Ethereum's long-term value proposition.

The launch of Ethereum spot ETFs has injected $1.3 billion into the market within two weeks, including $200 million in the past seven days alone. These inflows underscore Ethereum's evolution from a speculative asset to a mainstream investment vehicle. Market technicians now eye the $3,800-$4,000 range as the next logical resistance zone.

Coinbase Launches 'Base' Super App Integrating Trading, Payments, and AI

Coinbase has unveiled a redesigned mobile wallet that consolidates cryptocurrency trading, payments, social media, and on-device AI agents into a single platform. The limited beta, currently available to waitlisted users, represents a strategic shift for the exchange as it seeks to expand beyond its core trading business.

The new app leverages Coinbase's layer-2 network Base as its foundational infrastructure. 'Every post in the app is a coin,' the company announced, suggesting a model where creators can mint and monetize content directly through the platform.

This move aligns with CEO Brian Armstrong's vision of creating a Western counterpart to China's WeChat - an all-in-one ecosystem built on open protocols rather than walled gardens. The development follows Armstrong's 2023 argument that such super-apps could enable lower fees and innovative business models in the crypto space.

Will ETH Price Hit 4000?

ETH shows strong technical and fundamental alignment for a $4,000 test:

| Factor | Bullish Signal |

|---|---|

| Price vs. 20-day MA | 22.5% premium |

| MACD Trend | Converging toward crossover |

| Institutional Demand | $1B+ fresh allocations |

| ETF Catalysts | Staking features pending |

"The $3,360 Bollinger resistance is key," emphasizes Emma. "A weekly close above this level would confirm the path to $4,000 with potential acceleration from ETF inflows."

70% probability of reaching $4,000 by Q3 2025